Welcome to Odessa, the web and content specialists here in Ireland. We work with some of the leading online companies to bring them solutions that look good and more importantly, improve their bottom line.

Some of our previous clients

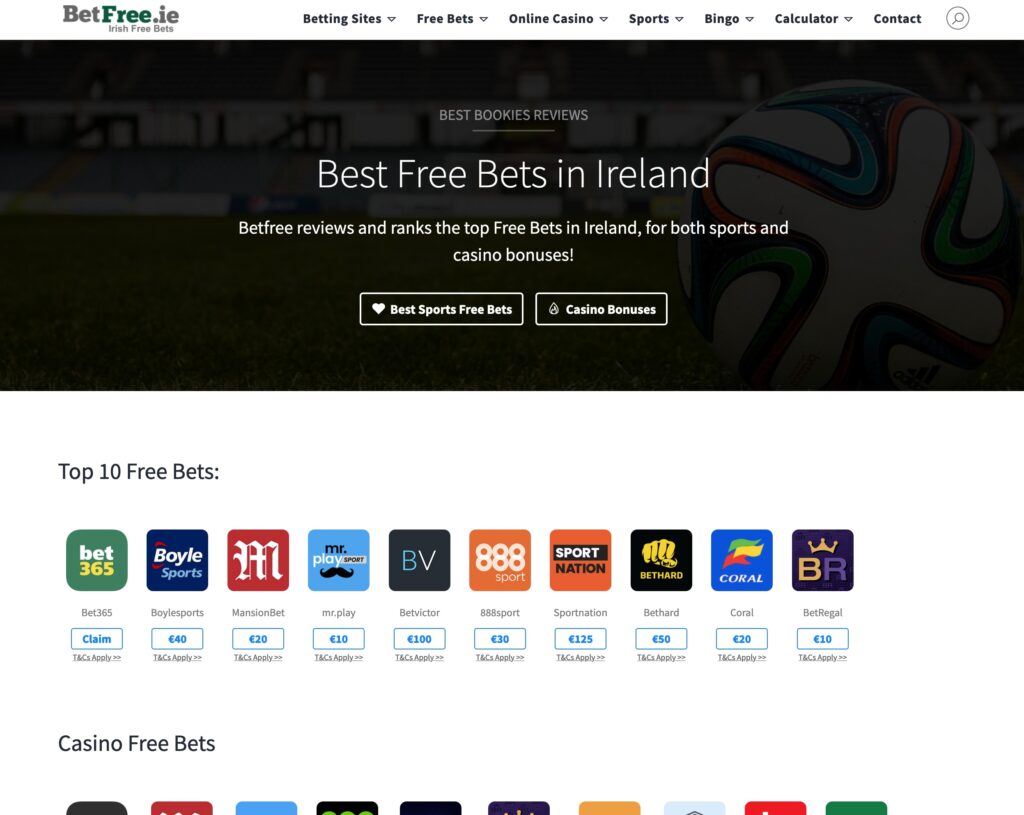

We worked with Betfree on their web design and their content on your “betting sites” page. Working with Clicky Analytics we were able to improve their conversion ratios and bounce time.

SuperValu is a household name in Ireland and we helped them create their upcoming offers content and product catalogs.